Fdic Insurance Changes 2025. The federal deposit insurance corporation is changing its policy for trust accounts effective april 1, 2025. As of april 1, 2025, the federal deposit insurance corporation (fdic) has implemented significant changes to its insurance coverage limits, particularly affecting.

Washington — the federal deposit insurance corporation (fdic) today approved a final rule to simplify aspects of the agency’s deposit insurance coverage rules. How fdic coverage of trust accounts has changed.

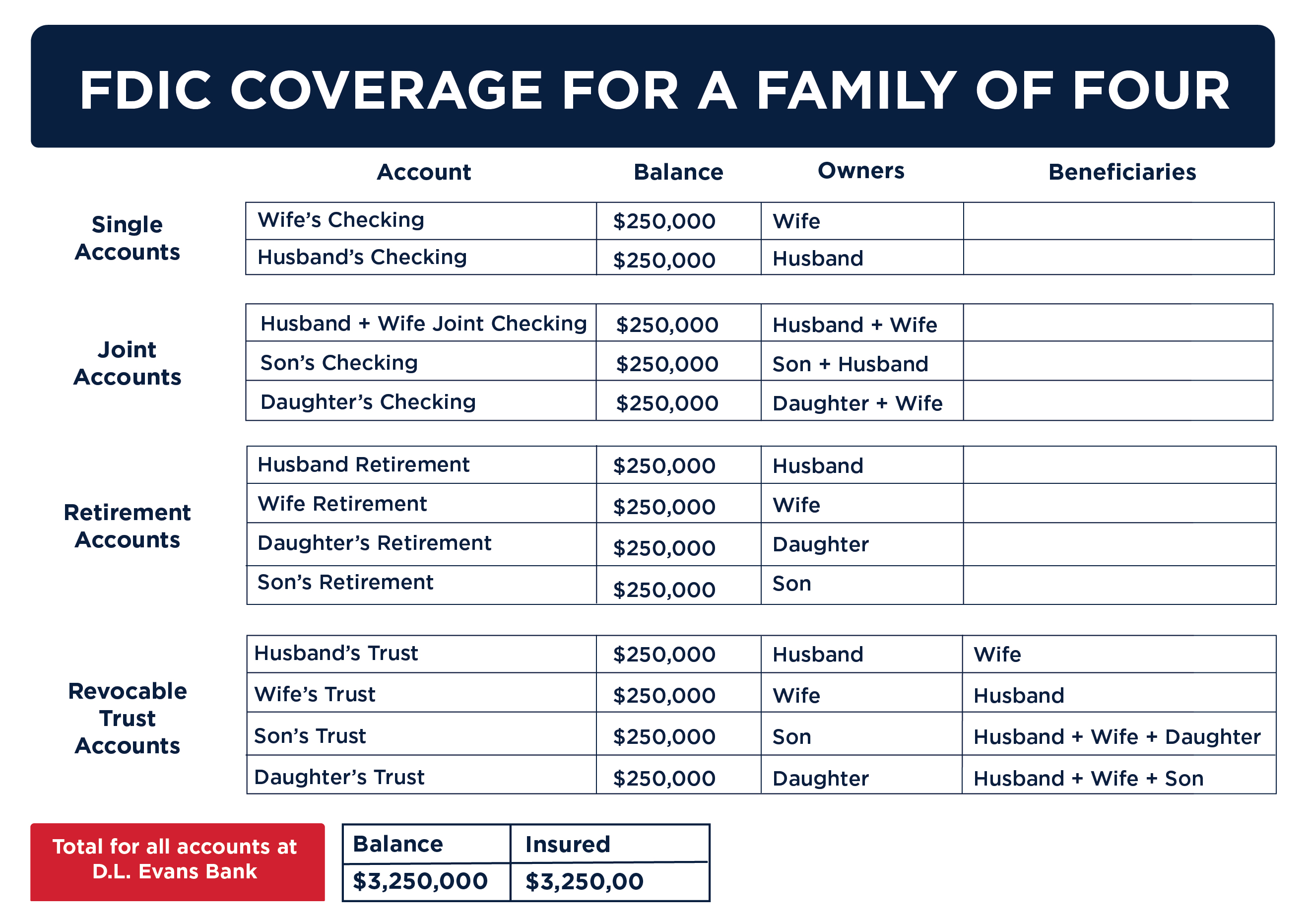

FDIC Insurance D. L. Evans Bank Serving Idaho & Utah, The highlights of the new rules are as follows: The fdic amended its regulations governing deposit insurance coverage.

Safe Sound and FDICInsured Farmers State Bank of Camp Point, The fdic amended its regulations governing deposit insurance coverage. If you are a typical depositor, you should experience no change in.

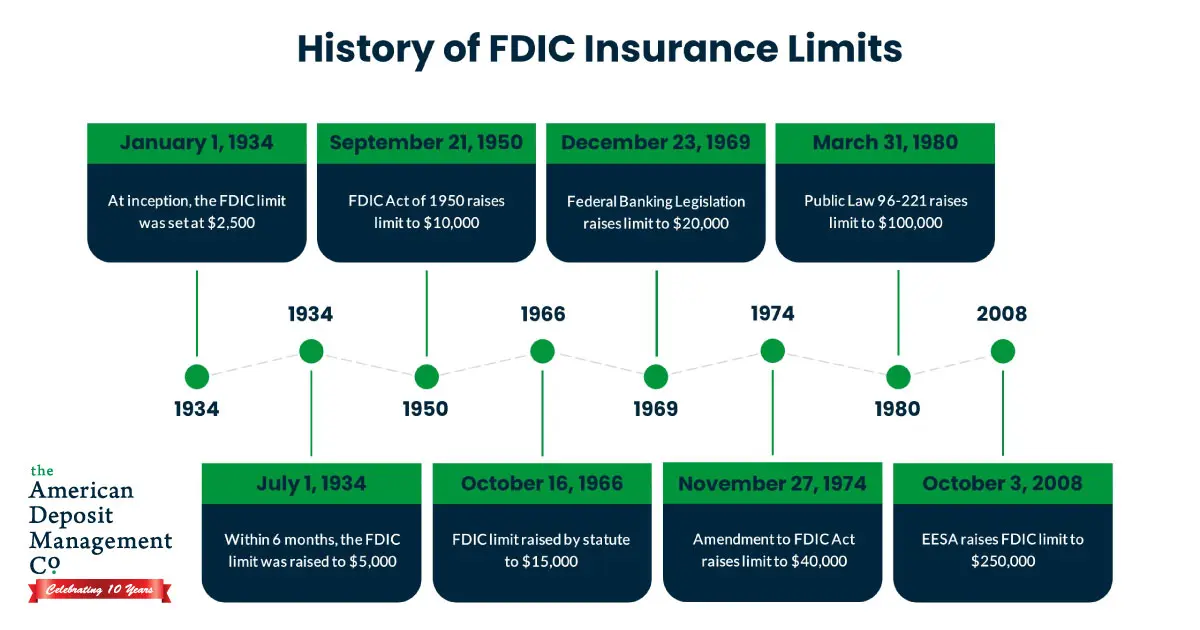

History and Timeline of Changes to FDIC Coverage Limits ADM, The federal deposit insurance corporation is changing its policy for trust accounts effective april 1, 2025. As of april 1, 2025, the federal deposit insurance corporation (fdic) has implemented significant changes to its insurance coverage limits, particularly affecting.

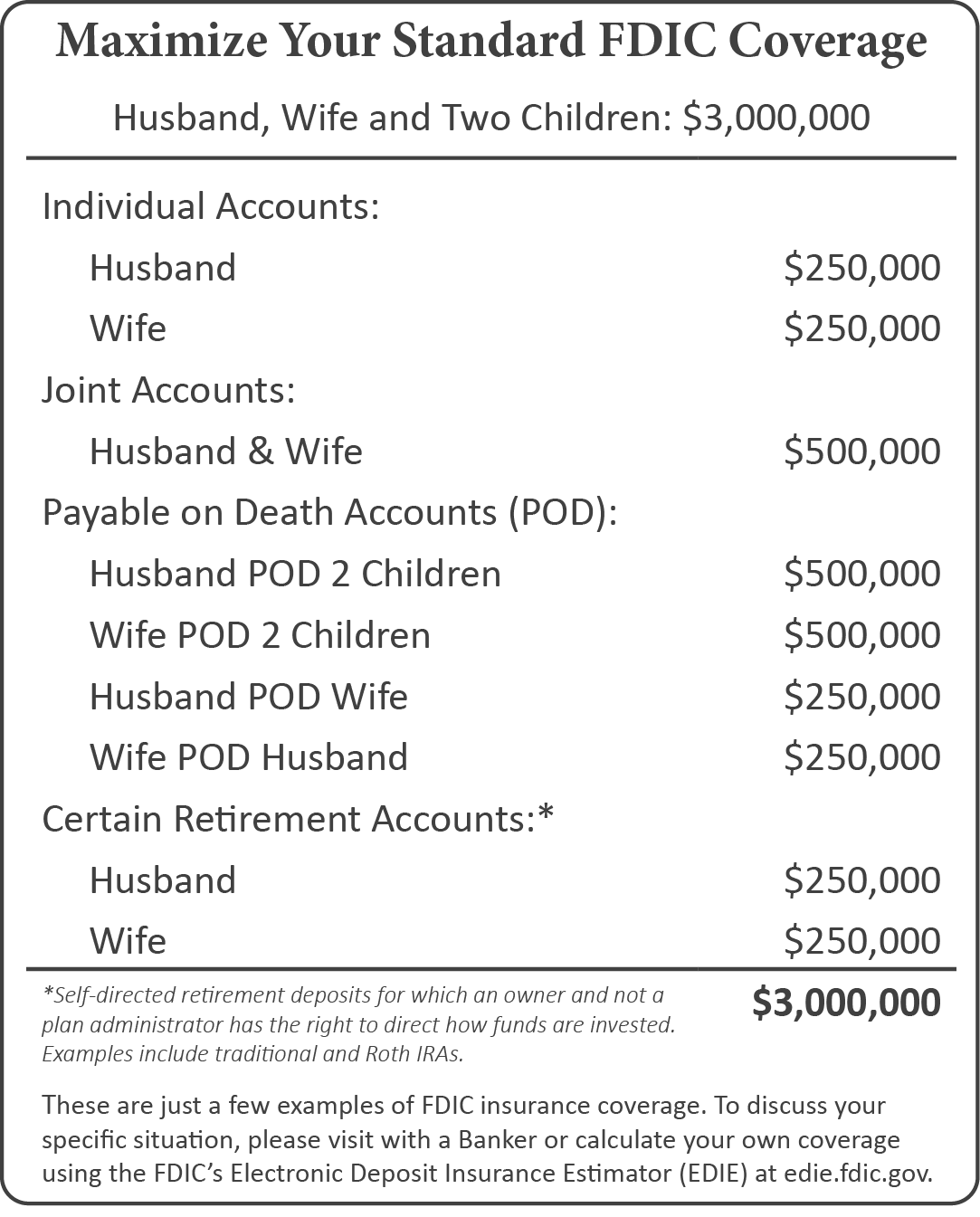

Understanding FDIC Insurance What Happens When A Bank Fails?, Under the new rules, trust deposits are now limited to $1.25 million in fdic coverage per trust owner per insured depository institution. What does deposit insurance cover?

FDIC Insurance Explained Bank of the Pacific, If you are a typical depositor, you should experience no change in. Washington — the federal deposit insurance corporation (fdic) today approved a final rule to simplify aspects of the agency’s deposit insurance coverage rules.

FDIC Options for Deposit Insurance Reform Data Library, The federal deposit insurance corporation (fdic) changed its deposit insurance coverage for some accounts effective april 1, 2025. The fdic amended its regulations governing deposit insurance coverage.

What is FDIC insurance? YouTube, The amendments simplify the deposit insurance regulations by establishing a trust. Under the new rules, trust deposits are now limited to $1.25 million in fdic coverage per trust owner per insured depository institution.

FDIC Insurance by Stream Realty Partners, Under the current rule, the fdic recognizes three difference insurance categories for deposits held in connection with trusts: Let us take a closer.

FDIC Insurance Understanding Coverage and Maximizing Benefits, How fdic coverage of trust accounts has changed. The changes are intended to make the deposit insurance rules easier to understand for depositors and bankers, facilitate more timely insurance determinations for trust.

FDIC Insurance and Coverage Limits, When the authors applied their framework to the change in the deposit insurance limit in early 2008, they came up with an optimal level of coverage of. As described in our previous client memo in may 2025, the fdic is amending its regulations governing deposit insurance to merge the revocable and.